» The Guardian – 18 August 2014:

UK energy dependence – five hidden costs expose truth about fracking

The shale boom is a bubble waiting to burst as economics of extraction falter and the trickle of bad environmental news starts to swell. Five sets of problems are emerging with the shale narrative: economic risk; local environmental cost; global environmental cost; social cost, and opportunity cost. Article by Jeremy Leggett

Real estate drama

If a drilling site is established on or near your property, expect the value of your house to diminish. Ray White Real Estate Mt Gambier reports of disastrous long-term effects.

“There is a short-term economic boost. Corporations bring in highly paid engineers. They spend some of their money in the small towns. But the industry activity can also cause real estate markets to collapse.

This is a quote from the Ray White Real Estate Mt Gambier website: “While the project may bring large piles of money to Australia’s government and large corporations, the long-term effects may be disastrous for our region and local farmers … This makes it even more important for everyone in our community to be educated in fracking and join forces to make their opinion heard, because we are the ones whose livelihoods will be directly impacted.”

The website includes alerts for residents and customers.”

~ Ross Mueller in Geelong Advertiser

“Who is a $1.3bn billion renewable energy cut helping? Mining companies, that’s who.”

Anonymous comment in a discussion thread

Gas prices to triple because of fracking

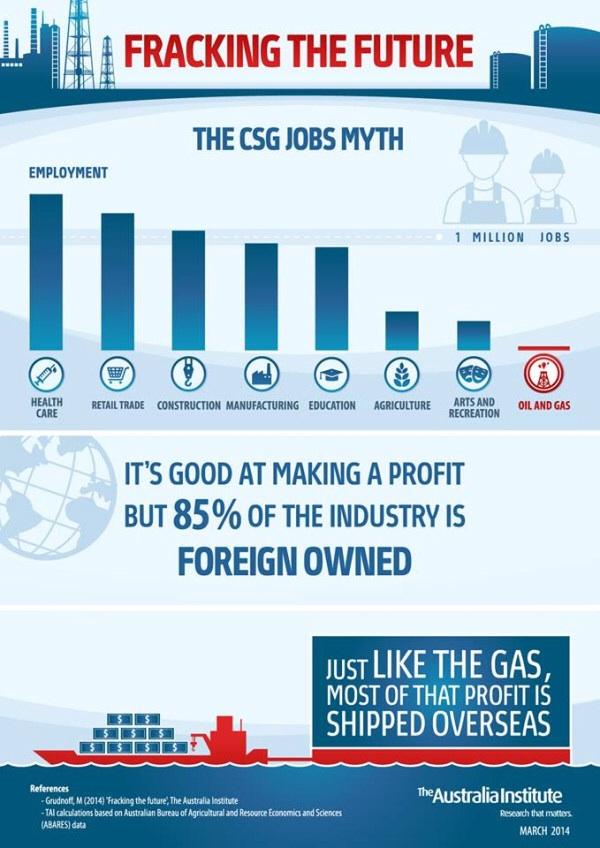

Mark Ogge is a researcher and a public liason officer to the Australia Institute. In this audio clip Mark Ogge talks about the economic impacts of fracking, and about the fact that the gas is for export, and why this will make gas prices go up for us, the consumers. The gas price in Asia is about five times the gas price in Australia. So exporting it is going to triple or quadrouple the gas prices here, he estimates.

» For information about Mark Ogge, see: www.bze.org.au

Fracking companies’ billion dollar debt

Is fracking such a good business as the gas companies and governments claim it to be?

New figures from the United States shows that the fracking economy is getting progressively worse, and fracking companies have had to increase their net debt by $106 billion to fill the hole.

“How much longer can the shale industry survive? I’m convinced that the Americans who play today’s big power game have this wrong, like so many others. Shell played at least part of it smartly, selling off shale plays. But many others keep diving in deeper all the time. While the situation is just getting worse. Before interest rates start to rise.

The graph says things have been getting progressively worse for all 5 years running. In 2013, only 60% of operational costs could be covered with production (the 2014 bar should be ignored, that’s an EIA estimate, and therefore 100% unreliable). What happens to this industry when borrowing costs double or triple? It’s a scary thing to ponder. How does ‘get out while you can’ sound?”

~ Raúl Ilargi Meijer in The Automatic Earth

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Fracking blows up balance sheets in US oil and gas industry

“Where money goes to die: How fracking blows up balance sheets of oil and gas companies” – excerpt of an article published on 30 July 2014 on wolfstreet.com

“Fracking [..] is causing the balance sheets of oil and gas companies to blow up. Now even the Energy Department’s EIA has checked into it and after crunching some numbers found: Based on data compiled from quarterly reports, for the year ending March 31, 2014, cash from operations for 127 major oil and natural gas companies totaled $568 billion, and major uses of cash totaled $677 billion, a difference of almost $110 billion. To fill this $110 billion hole that they’d dug in just one year, these 127 oil and gas companies went out and increased their net debt by $106 billion.

But that wasn’t enough. To raise more cash, they also sold $73 billion in assets. It left them with more cash (borrowed cash, that is) on the balance sheet than before, which pleased analysts, and it left them with a pile of additional debt and fewer assets to generate revenues with in order to service this debt. It has been going on for years. In 2010, the hole left behind by fracking was only $18 billion. During each of the last three years, the gap was over $100 billion. This is the chart of an industry with apparently steep and permanent negative free cash-flows:

And those shortages in each year forced the companies to raise more debt and sell assets to fund more drilling, other capital expenditures, operational costs, dividends, and stock buybacks. Of the three sources of cash – operations, net increase in debt, and asset sales – during the first quarters going back six years, net increases in debt accounted for over 20% of the incoming cash since 2012. For instance, In 2013, cash from operations supplied only 60% of the cash needs; most of the rest was borrowed, and some was covered by asset sales”

» Continue reading on www.wolfstreet.com

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

In this episode of the Keiser Report, Max Keiser and Stacy Herbert ask why, if fracking is so great, is it a state secret? A UK government report looking at the economic consequences in rural Britain is so heavily redacted that none are allowed to know the third “major social impact” the fracking process may cause.

They also discuss one energy analyst’s call for fracking as the ‘dotcom bubble’ of our age.

Published on youtube.com on 19 August 2014

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .